How to Know Which Depreciation Method to Use

Units of production method. The common methods used are.

Depreciation Formula Calculate Depreciation Expense

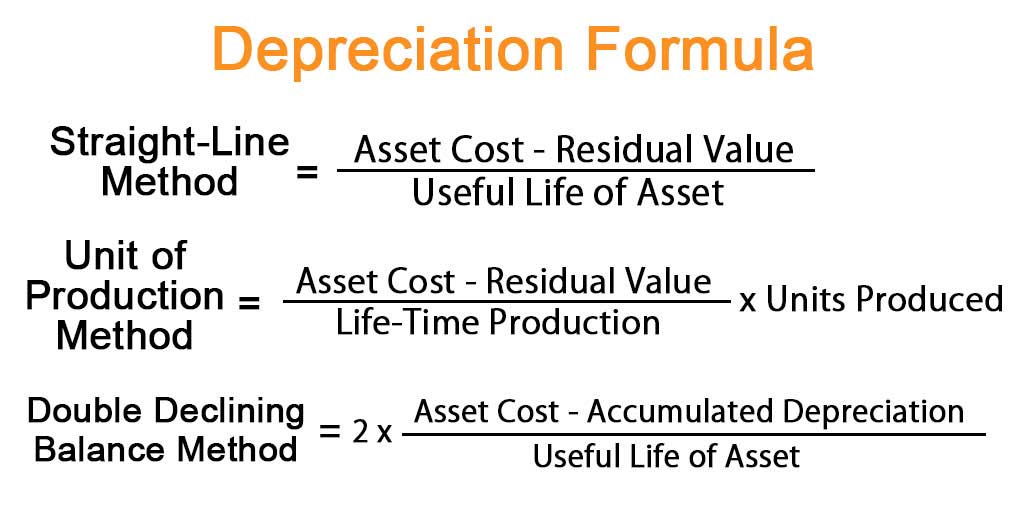

Straight-line depreciation Original value Salvage ValueUseful Life.

. In order to calculate the value the difference between the assets cost and the expected salvage value is. There are precisely four methods of depreciating an asset named as follows. Cost of asset salvage valueestimated useful life annual depreciation expense 600 1005 100 in annual depreciation expenses.

For example if an asset has a useful life of 10 years ie Straight-line rate of 10 the depreciation rate of 20 would be charged on its carrying value. One depreciation schedule for book financial purposes and one for tax purposes. A regulation relating to IRA rollovers stipulating that whenever a financial asset is withdrawn from a retirement account or.

Assume a business buys a machine for INR 1crore with a useful life of 25 years and a salvage value of INR 10 lakhs. Operations may choose to use two depreciation schedules. The method generally remains the same over the life of an asset.

New computers were bought for USD50000 and are expected to last ten years when they will be replaced. Companies can use several different methods to calculate depreciation on Fixed Assets. For allocating the cost of a capital asset Types of Assets Common types of assets include current non-current physical.

The depreciation amount is treated as an operating expense in the income statement whereas the asset is reported at its Net Book Value Cost Accumulated Depreciation in the balance sheet. SLM depreciation 10000000 100000025 360000. Same Property Rule.

Depreciation Depreciation Rate x Cost of the Asset in a given year Example 3. For the book method of depreciation there are four main depreciation methods that are used. 15-year and 20-year classes use 150 Declining Balance method GDS This depreciation method gives you a higher depreciation rate 150 more than the straight-line method.

Double declining balance depreciation is an accelerated depreciation method that charges twice the rate of straight-line deprecation on the asse ts carrying value at the start of each accounting period. Straight line depreciation is the most commonly used and straightforward depreciation method Depreciation Expense When a long-term asset is purchased it should be capitalized instead of being expensed in the accounting period it is purchased in. The formulas for Straight Line Method are.

The original price of the machinery is 5000 the estimated useful life is 10 years the estimated residual value is 500 and the depreciation is calculated according to the straight-line method. The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life. Annual Depreciation FC - SV n.

The following formula is used to calculate depreciation using Reducing Balance Method. GDS using 150 DB. The method is chosen at the time the asset is purchased and placed in service.

To determine the depreciation rate table to use for each asset refer to the MACRS Percentage Table Guide. For example the first-year calculation for an asset that costs 15000 with a salvage value of 1000 and a useful life of 10 years would be 15000 minus 1000 divided by 10 years equals 1400. The book depreciation schedule follows accounting principles and is used in business financial statements.

The straight-line depreciation method is the easiest to calculate and the annual depreciation amount original net value of assets-estimated residual value service life. The recommended formula for calculating depreciation using the units of production method is depreciation cost value salvage value units produced in useful life x number of units Lets practice on an item you paid 5000 with a salvage value of 250 that is supposed to provide 70000 hours of work during its lifetime. Straight Line Method is the simplest depreciation method.

This method focuses on the amount of. 27 years This tax depreciation method uses the straight-line formula under the GDS that calculates an even depreciation amount over the assets life. However you can choose to depreciate certain intangible property under the income forecast method discussed later.

Generally if you can depreciate intangible property you usually use the straight line method of depreciation. The annual amount is calculated as. You can calculate straight-line depreciation by subtracting the assets salvage value from the original purchase price and then dividing it by the total number.

It assumes that a constant amount is depreciated each year over the useful life of the property. This is the most commonly used method for calculating depreciation. All 3 assets will use Table A-1.

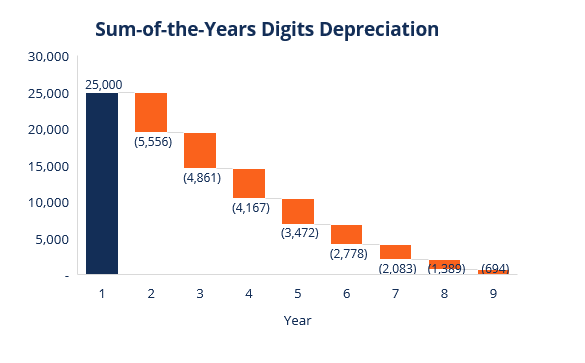

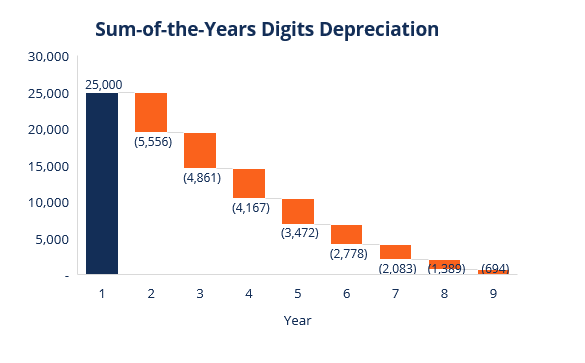

The business chose to use Reducing Balance Method to depreciate the. Sum of years digits. Straight Line Method of Depreciation.

Units of Activity or Production Depreciation. All 3 assets are considered to be nonfarm 5 and 7 year properties so we will use the GDS using 200 DB method. Straight-line depreciation is the most simple and commonly used depreciation method.

To determine the depreciation method to use refer to the Depreciation Methods table. Then there are tax depreciation schedules that follow Internal Revenue Service codes and regulations.

Depreciation Methods 4 Types Of Depreciation You Must Know

No comments for "How to Know Which Depreciation Method to Use"

Post a Comment